Original price was: KSh500.KSh399Current price is: KSh399.

Download December 2025 CPA Advanced Management Accounting Answers in Pdf form

Description

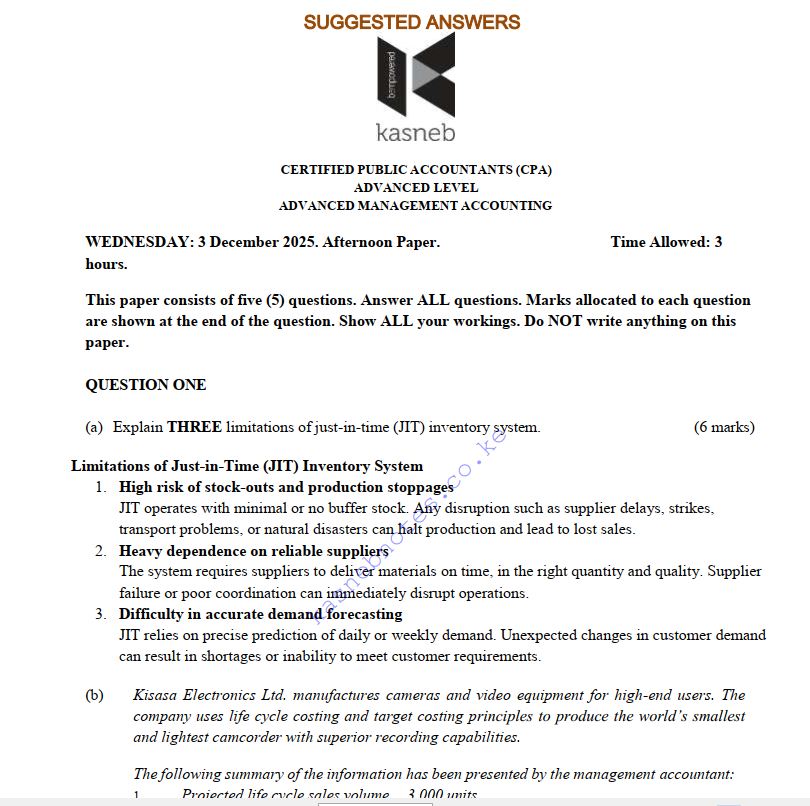

CERTIFIED PUBLIC ACCOUNTANTS (CPA) ADVANCED LEVEL

ADVANCED MANAGEMENT ACCOUNTING

WEDNESDAY: 3 December 2025. Afternoon Paper. Time Allowed: 3 hours.

This paper consists of five (5) questions. Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

(a) Explain THREE limitations of just-in-time (JIT) inventory system. (6 marks)

(b) Kisasa Electronics Ltd. manufactures cameras and video equipment for high-end users. The company uses life cycle costing and target costing principles to produce the world’s smallest and lightest camcorder with superior recording capabilities.

The following summary of the information has been presented by the management accountant:

1. Projected life cycle sales volume 3,000 units

2. Target selling price per unit Sh.8,000

3. Target profit margin 30%

4. Projected total cost based on linear regression analysis on product life cycle in present value terms are as follows:

Cost object Cost behaviour

Research and development costs: Y = 3,000,000 + 300X phase costs: Y = 2,500,000 + 250X

Production expenses per unit: Y = 1,610X Marketing and advertisement expenses: Y = 980,000 + 20X Distribution and delivery overheads Y = 1,000,000 + 100X Customer care service costs: Y = 1,205,000 + 375X

Where: Y#8211; Total actual cost

X#8211; Projected life cycle sales volume in units

Required:

Using target costing approach, compute unit cost gap for the product. (6 marks)

(c) Junction Cafeteria buys and sells hot take-away food. The cafeteria wants to decide on how many burgers to purchase for sale at a forthcoming outdoor concert. The number of burgers sold will depend on the weather conditions and any unsold burgers will be thrown away at the end of the day.

There is a 30% chance that the weather will be good, a 20% chance that the weather will be normal and a 50% chance that the weather will be bad.

The table below details the profit that would be earned for each possible outcome:

Number of burgers purchased

Weather 1,000 2,000 3,000 4,000

Sh. Sh. Sh. Sh.

Bad 1,000 0 (1,000) (3,000)

Normal 3,000 6,000 7,000 6,000

Good 3,000 6,000 9,000 12,000

Required:

The number of burgers to purchase to satisfy:

(i) Maximin criterion. (2 marks)

(ii) Maximax criterion. (2 marks)

(iii) Minimax criterion. (4 marks)

(Total: 20 marks)

QUESTION TWO

(a) The Management Accountant should carry out risk assessment and disaster preparedness when accounting for environmental costs. This is as a result of the dynamic environmental changes and government compliance requirements.

Required:

Analyse THREE interventions to implement and to take to minimise the impact of dynamic environmental risks and internal failure costs. (6 marks)

(b) One of the functions of the Management Accountant is to generate confidential reports for strategic internal decision making. However, most of these reports are flawed with integrity issues such as conflict of interest, creative accounting and lack of credibility.

Required:

With reference to Strategic Management Accounting Information, explain the meaning of the following Ethical Standards for Management Accountants:

(i) Confidentiality. (1 mark)

(ii) Integrity. (1 mark)

(c) Jikoni Ltd. is a manufacturer of edible vegetable oil branded “Soya oil”. The company uses three basic ingredients to make Soya oil. The standard data for a litre of “Soya oil” is as follows:

Standard cost per unit of “Soya oil”

Ingredients Standard mix ratio Standard price per litre

(Sh.)

Alpha

Beta Zeta 50%

30%

20% 70

50

20

A standard loss of 10% is expected in production. During the month of March 2025, the actual output was 92,700 litres of “Soya oil”.

The actual quantities mixed and actual cost data were as follows:

Ingredients Actual quantity used

(litres) Total cost

(Sh.)

Alpha

Beta Zeta 53,000

28,000

19,000 3,710,000

1,484,000

418,000

Required:

Calculate the following cost variances:

(i) Material price variance. (3 marks)

(ii) Material usage variance. (3 marks)

(iii) Material mix variance. (3 marks)

(iv) Material yield variance. (3 marks)

(Total: 20 marks)

QUESTION THREE

(a) The balanced Scorecard Model is an integrated model that combines both financial and non-financial performance measures of performance as opposed to conventional measures that focus only on quantitative financial performance measures.

With reference to the above statement, discuss TWO challenges you might encounter while analysing Public Sector performance using non-financial measures of performance. (4 marks)

(b) Tulia Ltd. is the leading manufacturer and distributor of executive mattresses in the country. The mattresses differ is size, quality and class of customers. The company is in the process of preparing its activity-based budget (ABB) for its main three types of mattresses. These are family, luxury and standard.

The following budgeted information is available for the budget period:

Type of mattress Family Luxury Standard

Current sales-mix 25% 40% 35%

Units produced and sold 1,250 units 2,000 units 1,750 units

“Sh. per unit” “Sh. per unit” “Sh. per unit”

Selling price per mattress Direct material (Sh.250 per kg)

Direct labour (Sh.500 per labour hour) 10,000

2,500

1,500 12,050

4,000

1,750 8,750

1,750

1,250

The total number of activities for each of the three types of mattresses for the period is as follows:

Type of mattress Family Luxury Standard Total

Number of purchase requisitions

Number of setups 1,200

240 1,800

260 2,000

300 5,000

800

Fixed overhead costs have been analysed as follows:

Cost pool Cost driver “Sh.”

Inspection for quality costs

Production scheduling costs General fixed overheads Number of purchase requisitions Number of setups

Number of units produced and sold 8,000,000

6,217,000

7,500,000

Total fixed costs 21,717,000

Additional information:

1. The total budgeted fixed overhead costs for the budget period are Sh.21,717,000.

2. The direct labour force is threatening to go on strike for two weeks out of the coming four weeks. This means that direct labour hours will be limited to 7,975 hours for production rather than the budgeted 15,950 hours.

3. The total overhead costs for the month of January 2026 have only been analysed into three cost drivers. The activity-based budgeting (ABB) will not be affected by the limitation in labour force strike.

Required:

(i) Weighted break-even point in units based on the current sales-mix. (4 marks)

(ii) If the strike goes ahead, determine which product(s) should be produced if profits are to be maximised. (6 marks)

(iii) Calculate the budgeted profit per unit for each of the three products using Activity-Based Budgeting (ABB). (6 marks)

(Total: 20 marks)

QUESTION FOUR

(a) Explain FOUR perspectives of a balanced scorecard matrix and state one performance measure of each perspective. (8 marks)

(b) Changamka Ltd., a manufacturing company, has been organised into responsibility centres. The following data relate to one of the cost centres of the company for the year ended 30 September 2025.

Changamka Ltd. statement of profit or loss for the year ended 30 September 2025:

Sh.“000” Sh.“000”

Sales 30,000

Less production cost:

Direct material 6,500

Direct labour 5,400

Variable production overhead 7,000

Prime cost (18,900)

11,100

Less variable overheads:

Variable selling costs (2,600)

Contribution 8,500

Less fixed costs:

Fixed selling costs 1,997

Administration expenses 2,100 (4,097)

Net profit 4,403

The following changes are expected to occur during the year ending 30 September 2026:

1. Selling price will be adjusted downward by 3% in order to attract more customers.

2. Adverse material price variance of 2% is expected due to change in the quality of material.

3. There will be a reduction in labour cost of 4% due to learning curve experience.

4. Variable production overheads will escalate by 3% due to overtime premiums paid.

5. Increase in the efficiency of sales persons will ease direct selling costs by 5%.

6. All other factors are expected to remain constant.

7. Marginal costing technique will apply to establish the contribution and net profit.

8. Target net profit is Sh.4.5 million.

Required:

For the year ending 30 September 2026, determine the following for the responsibility centre:

(i) Expected break-even point in sales value. (6 marks)

(ii) The level of sales to achieve the target profit of Sh.4.5 million. (4 marks)

(iii) Margin of safety in sales value. (2 marks)

(Total: 20 marks)

QUESTION FIVE

(a) Beta Ltd. makes and sells executive chairs. They are considering a new design of executive chairs to launch into the competitive market in which they operate.

The estimated cost structure is as follows:

Sh.

Mainframe bars per chair Leather material per metre

Labour cost per hour 50,125

10,000

15,000

Additional information:

1. Beta Ltd. wants a margin on selling price of 20%.

2. The first chair will take 2 hours to complete.

3. Leather material costs Sh.10,000 per metre and two metres are needed for a complete chair although 20% of all leather is wasted in the process.

4. The whole process will be subjected to a 90% learning curve effect.

5. The learning improvement will stop once 15 chairs have been made and the time for the 15th chair will be the time for all subsequent chairs.

Required:

(i) The average cost for the first 15 chairs. (8 marks)

(ii) The selling price per completed chair. (2 marks)

(b) JKZ retailers deal in a perishable commodity branded “XT”. The daily demand and supply are uncertain. The data for the past 500 days shows the following demand and supply:

Supply Demand

Availability (kg) Number of days Demand (kg) Number of days

10 40 10 50

20 50 20 110

30 190 30 200

40 150 40 100

50 70 50 40

Additional information:

1. The retailer buys XT at Sh. 200 per kg and sells it at Sh. 300 per kg.

2. Any amount of XT that remains at the end of the day has no saleable value.

3. An opportunity cost of unsatisfied demand is Sh. 80 per kg.

4. Random numbers for supply and demand are given as: (31,18); (63,84); (15,79); (07,32); (43,75); (81,27)

Required:

Using the above random numbers, simulate 6 days sales, demand and estimate the expected profit. (10 marks)

(Total: 20 marks)

…………………………………………………………………………………………………