Original price was: KSh500.KSh399Current price is: KSh399.

Download December 2025 CPA CIFA Public Finance and Taxation Past Paper answers in Pdf form

Description

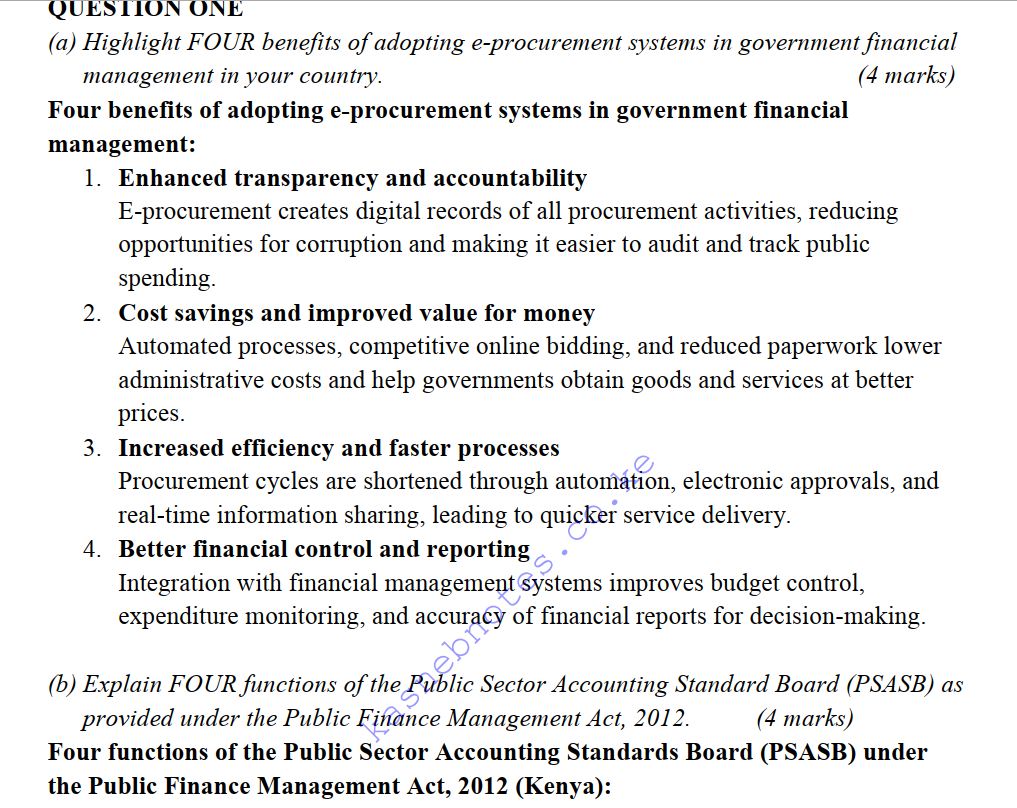

QUESTION ONE

(a) Highlight FOUR benefits of adopting e-procurement systems in government financial management in your country. (4 marks)

(b) Explain FOUR functions of the Public Sector Accounting Standard Board (PSASB) as provided under the Public Finance Management Act, 2012. (4 marks)

(c) Explain THREE strategies that county governments, through Council of Governors (COG) could use to strengthen financial management in county governments. (6 marks)

(d) The government of Masaba plans to use Public Private Partnerships (PPPs) to finance, build and deliver large scale affordable housing in your country.

Discuss THREE measures that the government should put in place to mitigate the risks inherent in such PPP projects. (6 marks)

(Total: 20 marks)

QUESTION TWO

(a) The National Treasury is mandated with the preparation of annual budget estimates, co-ordination and preparation of the national government budget. Towards this function, the cabinet secretary issues out a treasury circular.

In relation to the above statement, summarise FOUR contents of treasury budget circular. (4 marks)

(b) Explain FOUR reasons why the revenue authority in your country should put in place measures to reduce tax evasion. (4 marks)

(c) Podcast Electronics Ltd. is registered for value added tax (VAT) purposes and deals in electronic items. The company provided the following transactions for the month of October 2025:

October 1: Purchased 20 tablets at Sh.28,000 each.

October 2: Imported 10 laser printers at a total cost of Sh.300,000 exclusive of import duty. October 4: Sold 10 tablets at Sh.36,400 each.

October 5: Purchased 300 power banks at Sh.1,500 each. October 6: Sold 6 laser printers for a total of Sh.190,000

October 8: Sold 50 smart watches at Sh.6,380 each purchased in the month of September 2025 for a cost of Sh.4,800 each.

October 12: Purchased 200 wireless chargers at Sh.2,320 each from a VAT non-registered supplier. October 13: Sold 80 wireless chargers at Sh.3,480 each.

October 18: Purchased computer accessories for a total of Sh.140,000.

October 24: Sold 40 smart watches at Sh.6,000 each purchased in the month of September for Sh.4,250 each.

October 27: Sold 9 computer monitors at Sh.20,880 each on credit. The computer monitors had been purchased in the month of August 2025 for a total cost of Sh.150,000. The customer will pay in the month of November 2025.

October 30: Sold 5 tablets at Sh.33,640 each and paid the following expenses at the end of the month.

Sh.

Electricity expenses (including prepayment for the 14,500

month of November 2025 of Sh.3,500)

Water expenses supplied by county government 22,000

Delivery motor vehicle servicing 18,000

Staff lunch catering services 12,000

All transactions were inclusive of VAT at the rate of 16% where applicable. The import duty was at the rate of 25%.

Required:

Calculate the VAT payable by or refundable to Podcast Electronic Ltd. for the month of October 2025. (12 marks)

(Total: 20 marks)

QUESTION THREE

(a) Explain the following terms as used in taxation:

(i) Catering levy. (2 marks)

(ii) Advalorem customs duty. (2 marks)

(b) Evaluate FOUR roles of excise stamp in excise duty management in your country. (4 marks)

(c) Janet Moraa is an employee of Elite Tech Limited. The following information relates to her employment income and other incomes for the year ended 31 December 2024:

1. She earned a basic salary of Sh.225,000 per month (PAYE deducted Sh.54,200 per month).

2. The employer provided her with a rented house at a monthly rental rate of Sh.40,000 for which she contributed Sh.10,000 per month towards rent. The house is fitted with an internet connection whose average monthly cost is Sh.6,800 fully paid by the employer. The house is fully furnished at a cost of Sh.480,000.

3. She contributed Sh.35,000 per month to a registered pension scheme and the employer contributed a similar amount.

4. She is provided with a company car, Toyota Prado, 3000cc which cost the employer Sh.3,500,000 as at 1 January 2024.

5. On 1 October 2024, she relocated to her own residential house purchased through a 10% mortgage loan of Sh.8,000,000 obtained on 1 April 2024.

6. On 1 July 2024, she took an education insurance policy for her two children, paying a monthly premium of Sh.9,500 for each child.

7. In November 2024, she was away from her workstation for six days on official duty, for which she received a per diem of Sh.4,800 per night.

8. Other incomes earned during the year:

• Residential rental income (gross) Sh.720,000. The expenses related to rental property included; caretaker’s salary per month Sh.12,000, drafting lease agreement Sh.19,600, installation of burglar proof doors Sh.48,000 and 10% per annum interest on mortgage loan Sh1,200,000 obtained for structural alterations to maintain existing rent.

• Dividends (net of withholding tax) from Maara Cooperative Society Sh.51,000.

9. She paid Sh.15,000 during the year as subscription fee to her professional body.

Required:

(i) Compute the total taxable income of Janet Moraa for the year of income 2024. (10 marks)

(ii) Determine tax (if any) payable on the income computed in (c) (i) above. (2 marks)

(Total: 20 marks)

QUESTION FOUR

(a) As part of a national policy review team, you have been tasked with advising the government on how to improve the long-term sustainability of its public debt.

Explain FOUR strategic measures that the government could adopt to ensure that public debt remains sustainable and does not compromise economic stability. (8 marks)

(b) Delta Lines Ltd., a registered company, started its operations of manufacturing electrical cables on 1 January 2024. The company’s statement of profit or loss for the year ended 31 December 2024 indicated the following:

Sh.“000” Sh.“000”

Sales 12,600

Discount received 216

Dividends from a co-operative society 1,440

Profit on disposal of a tractor 672

14,928

Expenses:

Cost of cable manufacturing 4,632

Salaries and wages 1,446

Depreciation charges 164

Sh.“000” Sh.“000”

Advertisement expenses 300

Donation to political parties 820

Directors’ fees 1,800

VAT paid 1,530

Legal fees 1,152

Dividend paid 4,605

Repairs and maintenance 744 (17,193) Net profit (loss) (2,265)

Additional information:

1. Legal fees comprised the following:

Sh.

Parking fines 144,000

Stamp duty on land 576,000

Collection of debts from customers 180,000

Settling a dispute with a customer 252,000 1,152,000

2. Repair and maintenance include Sh.336,000 spent on the purchase of conveyor belts during the year.

3. The tractor disposed of during the year had cost Sh.2,640,000 at the beginning of the year.

4. The following assets were acquired at the beginning of the year:

Assets Sh.

Pick up 6,020,000

Heating plant 2,760,000

Computers 820,000

Water pump 552,000

Furniture 300,000

Tractors 6,230,000

Processing machines 4,340,000

2 saloon cars (each Sh.3,200,000) 6,400,000

5. On 1 January 2024, the company purchased a factory building from Mapato Ltd. a registered contractor for Sh.18,720,000 made up as follows as provided by Mapato Ltd.:

Sh.

Acquisition of land 2,500,000

Demolition of old building on site 1,900,000

Factory building 10,760,000

Stone perimeter wall around the factory 3,000,000

Bank interest paid on loan relating to construction 560,000

6. The factory building included the showroom and a retail shop constructed at a cost of Sh.1,200,000 and Sh.960,000 respectively.

7. A godown and staff quarters were constructed at a cost of Sh.2,860,000 and Sh.1,620,000 respectively and put into use from 1 October 2024.

Required:

(i) Capital allowance due to Delta Lines Ltd. for the year ended 31 December 2024. (7 marks)

(ii) A statement of adjusted taxable profit or loss for Delta Lines Ltd. for the year ended 31 December 2024.(5 marks)

(Total: 20 marks)

QUESTION FIVE

(a) Assuming you have been invited by the revenue authority of your country for a roundtable discussion in relation to “taxable capacity”.

Required:

Propose FOUR factors that influence the taxable capacity in your country that you could present for discussion.(4 marks)

(b) Identify FOUR objectives of Voluntary Tax Disclosure Programme (VTDP) introduced by the Revenue Authority under Finance Act, 2020. (4 marks)

(c) Alice and Kibet are partners in Betacity Traders in a general supplies business. They share profits and losses in the ratio of 2:1 respectively. The following is the statement of profit or loss of the partnership for the year ended 31 December 2024:

Betacity Traders

Statement of profit or loss for the year ended 31 December 2024

Sh. Sh.

Incomes

Sales 10,820,000

Insurance compensation on stolen inventory 185,000

Trade bad debts recovered 132,000

Revaluation gain on land 420,000

Realised foreign exchange gain 500,000

Discount received 299,000

Total income 12,356,000

Less expenses:

Purchase of goods for sale 5,220,000 Purchase of point-of-sale equipment 395,000 Partners salaries 1,200,000

Legal and professional fees 1,080,000

Repairs and maintenance 980,000

Rent and utilities 428,000

Interest on partners’ capital 132,000

General expenses 1,060,000

Vehicle expenses 776,000

Staff welfare 292,000

Depreciation 510,000

Partners bonus 960,000

Audit and consulting fees 124,000

(13,157,000)

Net loss (801,000)

Additional information:

1. Sales and purchases are inclusive of VAT at the rate of 16%.

2. Closing inventory was valued at Sh.210,000 while opening inventory was valued at Sh.480,000. Both were understated by 10%.

3. Legal and professional fees include:

Sh.

Legal fee for debt recovery 180,000

Legal advise on tax dispute 140,000 Land registration for new shop premises 160,000 Drafting lease agreement: 30 years 95,000

Trademark renewal 80,000

Legal fees on loan negotiation 120,000

Staff employment contracts 200,000

4. Repairs and maintenance comprise: Sh.

Renovation of showroom 460,000

Repainting 85,000

Partitioning of reception area 220,000

Purchase of office furniture 215,000

5. General expenses include: Sh.

Donation to a political party 180,000

Provision for general doubtful debts 220,000

Partners personal drawings 600,000

6. Partners dues were paid according to their profits and loss sharing ratio.

7. Investment allowance for the year was agreed with the revenue authority to be Sh.380,000.

Required:

(i) Compute the taxable profit or loss of the partnership for the year ended 31 December 2024. (9 marks)

(ii) Taxable income of each partner for the year ended 31 December 2024. (3 marks)

(Total: 20 marks)

……………………………………………………………………………………