Original price was: KSh500.KSh299Current price is: KSh299.

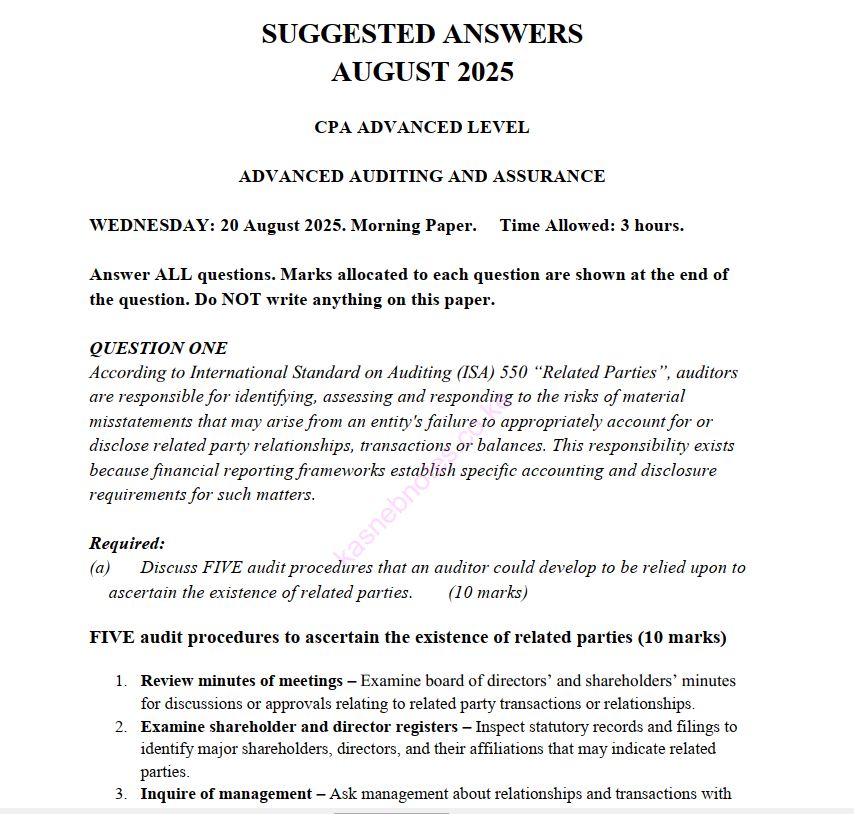

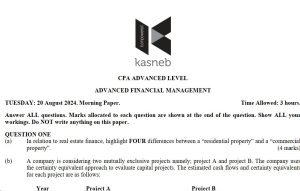

Download August 2025 CPA Advanced Auditing and Assurance Past papers with answers in Pdf form

Description

QUESTION ONE

According to International Standard on Auditing (ISA) 550 “Related Parties”, auditors are responsible for identifying, assessing and responding to the risks of material misstatements that may arise from an entity’s failure to appropriately account for or disclose related party relationships, transactions or balances. This responsibility exists because financial reporting frameworks establish specific accounting and disclosure requirements for such matters.

Required:

(a) Discuss FIVE audit procedures that an auditor could develop to be relied upon to ascertain the existence of related parties. (10 marks)

(b) You are the audit manager at Hapa and Pale Associates, a firm of Certified Public Accountants and you are currently reviewing the audit file of Wasafiri Ltd. for the year ended 30 June 2025. Wasafiri Ltd. is engaged in the export of raw coffee to the international market.

During the course of the audit, a junior team member identified several repetitive large payments made by the client to a consulting firm registered in a tax haven. When management was asked to explain the nature and purpose of these payments, they provided only minimal supporting documentation and offered vague explanations, merely stating that the payments were for “market research”.

Required:

(i) Identify FIVE red flags that could indicate the risk of money laundering at Wasafiri Ltd. (5 marks)

(ii) As the audit manager responsible for this audit, explain FIVE appropriate steps you might take upon receiving this information. (5 marks)

QUESTION TWO

(a) You are the audit engagement partner of Integrity and Integrity Associate, a firm of Certified Public Accountants. Your firm has launched an aggressive marketing campaign, which includes online advertisements with the assertive message: “We guarantee your company will pass any audit with us by your side”.

In a separate matter, one of your audit clients, Tangaza Holdings Ltd., a family-owned telecommunications company has offered your audit team all-expenses-paid trips to Dubai as a gesture of appreciation for their work during the audit. However, you are aware that Tangaza Holdings Ltd.’s recent press reports have raised concerns about possible regulatory violations in the company’s mobile money operations.

Required:

(i) Evaluate THREE ethical implications of the firm’s advertising campaign, with reference to the International Ethics Standards Board for Accountants (IESBA) Code of Ethics and Institute of Public Accountants of Kenya (ICPAK) guidelines on advertising and publicity. (6 marks)

(ii) Summarise THREE ethical threats arising from the client’s gift offer. (3 marks)

(iii) Recommend THREE appropriate safeguards as a response to the threats identified in (a) (ii) above. (3 marks)

(b) You are the audit manager in Summer and Sammer Associates, a firm of Certified Public Accountants, responsible for planning and executing the group audit of Africom Holdings Ltd. for the year ended 30 June 2025. Africom Holdings Ltd. is a diversified investment holding company with its headquarter in Nairobi, Kenya, with a broad portfolio across East Africa and the Indian Ocean region. The company holds controlling interests in three key subsidiaries located in Uganda, Tanzania and Mauritius. Each of these subsidiaries operates independently, maintaining separate financial reports and engaging their own external auditors.

Africom Holdings Ltd. is listed on the Nairobi Securities Exchange and as such, its consolidated financial statements are prepared in accordance with International Financial Reporting Standards (IFRS) and are subject to regulatory oversight by the Capital Markets Authority of Kenya.

Group structure and operations:

1. Tanzanian Subsidiary – Africom Tanzania Ltd.

Operates primarily in the telecom infrastructure sector. It was recently penalised by the Tanzania Foreign Exchange Licensing Authority for breaching local foreign currency repatriation rules. This fine, amounting to a significant sum, has not yet been disclosed in the group’s interim financial statements. The subsidiary is audited by a Tanzanian firm that is part of the Summer and Sammer Associates Certified Public Accountants international network.

2. Ugandan Subsidiary – Africom Uganda Ltd.

Provides micro-financing and digital payment services to rural communities. The Ugandan component’s audit is conducted by a local audit firm not affiliated with the Summer and Sammer Associates Certified Public Accountants international network. You note that during the discussions that the local auditor has historically had limited experience with group reporting and International Financial Reporting Standards (IFRS) compliance.

3. Mauritius Subsidiary – Africom Mauritius Ltd.

Functions as the group’s financial investment arm and engages in complex derivative trading, including foreign exchange options, interest rate swaps and crypto-index futures. The subsidiary has reported substantial unrealised gains from its derivatives portfolio. The Mauritius operations are subject to oversight by the Mauritius Financial Services Commission (FSC), with stringent regulations on valuation methodologies and disclosure requirements.

Required:

Analyse FOUR areas the auditor could consider during the preliminary planning of the Africom Holdings group audit. (8 marks)

QUESTION THREE

(a) Explain THREE differences between “assurance engagements” and “non-assurance engagements”. (6 marks)

(b) The Companies Act, 2015 (Kenya), along with International Standards on Auditing (ISA), governs the preparation and retention of audit working papers.

With reference to the above statement explain the following:

(i) Use of audit working papers. (2 marks)

(ii) Content of audit working papers. (2 marks)

(iii) Retention of audit working papers. (2 marks)

(iv) Confidentiality and safeguarding of working papers. (2 marks)

(c) You are the audit manager in the audit of Fresh Start Ltd. a manufacturing firm, for the year ended 31 March 2025. The final audit for the year is almost complete and your team is reviewing the working papers. The audit senior has raised an issue of a major supplier to the company who fraudulently inflated invoices. This led to a Sh. 200 million overstatement in inventory and payables. Fresh Start Ltd. has sued your audit firm for negligence, breach of contract and statutory liability, arguing:

1. Contractual duty breached:

The auditors failed to detect and report material misstatements despite having an obligation to exercise professional skills and due care (established in contract via the engagement letter).

2. Negligence: (Tort):

Their duty extends to the company (“third-party” in tort) and failure to detect fraud constitutes negligence, causing foreseeable financial loss.

3. Statutory Liability under Companies Act:

Civil Liability: Responsible officers (including auditors) risk damages for misuse of position or breach of trust under Section 206.

Criminal Liability: Under Section 46, making a materially false audit statement with intent to deceive attracts up to 7 years’ imprisonment.

Required:

Discuss the potential legal liabilities of the auditors in relation to each of the claims by Fresh Start. (6 marks)

QUESTION FOUR

(a) You are the audit manager responsible for the audit of Mawega Ltd. a medium-sized technology company that provides software solutions to businesses for the year ended 31 March 2025. The final audit for the year is almost complete and you are reviewing the audit working papers. The following matters have been raised by the audit senior for your attention:

1. Termination of a major client contract

Two weeks after the reporting date, Mawega Ltd.’s largest client (which represents 40% of the company’s annual revenue) terminated its contract. The client cited significant data protection concerns as the primary reason for the termination. This client had been a critical source of revenue and the loss could have a material impact on the company’s financial performance going forward.

Management’s position

The company has expressed confidence that the company will recover from this setback by securing new clients. However, the company has not yet signed any replacement contracts or secured any new business in the short term.

2. Short-term loan for payroll obligations

After the reporting date, the company obtained a short-term loan of Sh.50 million from a local financial institution. The loan was intended to meet payroll obligations for the next two months due to cash flow difficulties. This loan is a temporary measure and the company has expressed that it demonstrates financial resilience, reinforcing their belief that the company is a going concern.

Management’s position

Management is confident that the loan reflects a temporary challenge and that the company will be able to stabilize its financial position shortly. However, the company has not presented a detailed plan on how they intend to address the underlying cash flow issues or repay the loan.

3. Related party transaction

During the audit, a related party transaction was noted where the Chief Executive Officer’s (CEO) private company leased equipment to Mawega Ltd. at above-market rates. The nature of the related party relationship was not disclosed in the financial statements and the lease payments appear to be significantly higher than industry standards for similar equipment.

Management’s position

Management has not provided an explanation for the discrepancy in lease terms and has not made any disclosures regarding the related party relationship in the financial statements, asserting that the lease arrangement was made based on mutual agreement with no intention of evading compliance.

Required:

(i) For each of the matters above, evaluate the implications of the post-reporting date events for the auditor’s assessment of the going concern assumption. (9 marks)

(ii) Determine whether these events require adjustment or disclosure under International Accounting Standards (IAS) 10, “Events After the Reporting Period”. (3 marks)

(b) Discuss FOUR effects of the COVID-19 pandemic on the following areas in audit:

(i) Audit quality. (2 marks)

(ii) Fraud risks. (2 marks)

(iii) Remote auditing. (2 marks)

(iv) Role of technology. (2 marks)

QUESTION FIVE

(a) Evaluate FIVE considerations that should be included in the preparation of group reporting instructions to component auditors. (10 marks)

(b) An agreed-upon procedures engagement is a type of engagement where the auditor is not required to provide assurance. However, certain conditions must be met for the engagement to take place and there is a shared responsibility regarding the performance and outcomes of the procedures.

Required:

Summarise FIVE conditions and shared responsibilities involved in an agreed-upon procedures engagement, considering the auditor does not provide assurance. (10 marks)