Original price was: KSh300.KSh199Current price is: KSh199.

Description

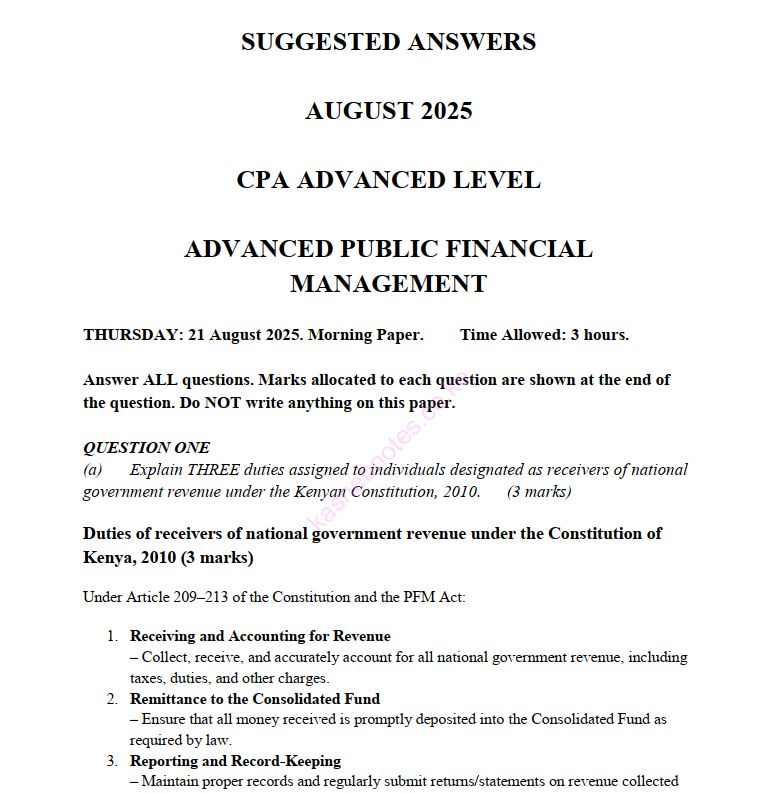

QUESTION ONE

(a) Explain THREE duties assigned to individuals designated as receivers of national government revenue under the Kenyan Constitution, 2010. (3 marks)

(b) As a policy advisor attending a Public Finance Management conference, you are required to make a presentation on the practical implications of Section 6(1) of the PFM Act, 2012 which requires that the provisions of the Public Finance Management Act shall prevail in case of conflict with any other legislation.

Required:

(i) In your presentation, examine SEVEN circumstances under which the Public Finance Management Act prevails over other legislations. (7 marks)

(ii) Analyse FIVE rationales for the PFM Act prevailing over other laws. (10 marks)

(Total: 20 marks)

QUESTION TWO

(a) Section 123 of the Public Finance Management Act, 2012 requires the county treasury to submit a Debt Management Strategy Paper to the county assembly on or before 28th February each year.

Required:

(i) Outline FOUR reasons why counties should have a well-defined debt management strategy. (4 marks)

(ii) Analyse FOUR contents of County Debt Management Strategy Paper. (8 marks)

(b) Describe FOUR responsibilities of the National Treasury in the management of state corporations in your country.

(8 marks)

(Total: 20 marks)

QUESTION THREE

(a) Explain FIVE ways of improving budget preparation process in order to enhance fiscal responsibility and efficiency in your country. (10 marks)

(b) Resource Mobilisation department is one of the three technical departments under Public Debt Management Office.

With reference to the above statement, analyse FIVE functions of Resource Mobilisation department. (10 marks)

(Total: 20 marks)

QUESTION FOUR

(a) Explain FIVE challenges facing counties in attaining financial sustainability and achieving service delivery objectives. (5 marks)

(b) Analyse FIVE areas covered in the scope of Public Financial Management. (5 marks)

(c) Examine FIVE roles of the Public Finance Management Committee (PFMC) under the Commission on Revenue Allocation in Kenya. (10 marks)

(Total: 20 marks)

QUESTION FIVE

(a) Explain TWO circumstances under which the County Executive Committee member for finance may make payments from the county government’s Emergency Fund. (4 marks)

(b) Examine FOUR challenges facing by the Office of the Auditor General (OAG) in auditing public funds. (8 marks)

(c) Describe FOUR strategies that the Public Procurement Regulatory Authority (PPRA) in Kenya has adopted to overcome the challenges in fulfilling its mandate. (8 marks) (Total: 20 marks)

…………………….…………………………………………