Original price was: KSh300.KSh199Current price is: KSh199.

Description

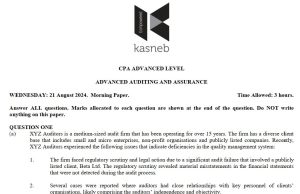

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Do NOT write anything on this paper.

QUESTION ONE

(a) The management of public debt in a responsible manner is very critical to any government since it supports economic growth and build investor confidence.

With reference to the above statement, explain FOUR benefits accruing from prudent debt management in the public sector. (8 marks)

(b) The legislative arm of government in your country plays a critical role in shaping, approving and overseeing fiscal policies.

In reference to the above statement, examine FOUR ways through which the legislative arm of government contributes to overall fiscal policy of your country. (8 marks)

(c) Highlight FOUR ways in which the government effectively manages the consolidated fund to ensure financial stability in your country. (4 marks)

(Total: 20 marks)

QUESTION TWO

(a) Explain FIVE ways in which the findings and recommendations from internal audits impact the scope, focus and effectiveness of audits conducted by the Office of the Auditor General in Kenya. (10 marks)

(b) Examine FIVE primary responsibilities and duties of the accounting officer in overseeing the management of receivers’ revenue within government entities in Kenya. (10 marks) (Total: 20 marks)

QUESTION THREE

(a) Your country is working to enhance the efficiency of public sector investments to boost economic growth and improve public service delivery. However, obstacles such as poor management, limited capacity and inadequate stakeholder involvement often hinder progress. To overcome these challenges, essential measures have been outlined, including conducting feasibility studies, implementing effective monitoring and evaluation systems and fostering stakeholder engagement.

Required:

(i) Explain TWO ways in which feasibility studies contribute to addressing these challenges in public sector investments. (4 marks)

(ii) Analyse TWO reasons for robust monitoring and evaluation in mitigating the identified challenges.

(4 marks)

(iii) Describe TWO ways in which stakeholder engagement can be enhanced to improve public sector investments. (4 marks)

(b) Examine FOUR principles of public finance. (8 marks)

(Total: 20 marks)

QUESTION FOUR

The Medium-Term Expenditure Framework (MTEF) is considered appropriate in developing countries because there is fragile linkage between the budgeting system and planning. The MTEF is one of the aspects of the Public Financial Management, which incorporates planning into budgeting over the medium term. It should guide annual budgets, as it is argued that it links policy, plans and budgets over a medium-term period of three to five years. The MTEF should enable organisations envision the effects of policies over several years and support effective resource allocation. Its rationale is to enable organisations to incorporate future fiscal challenges into their annual budgets more adequately, thereby reducing undue emphasis on short-term goals. It should encourage ongoing reallocation and broaden the budgeting scope. The MTEF is meant to achieve a balanced budget, shift resources to pro-poor activities and further the practices of good governance. Western donors, such as the International Monetary Fund (IMF) and the World Bank, have actively promoted MTEF reform in developing countries by making their contributions conditional on its adoption and implementation.

Despite being considered an aspect of effective budgetary management, it has been reported to be complex and challenging, even in developed countries. Public financial management experts criticise the MTEF and its implementation with the experts questioning MTEF effectiveness and reliability in guiding annual budget processes. The experts also argue that the MTEF conflicts with annual budgeting as it may distract actors from basic budgeting problems in annual budgeting and they also note that little attention has been paid to demonstrate how such conflicts occurs and how organisational actors respond to such conflicting demands. Although the MTEF is argued to be complex, some Public Financial Management experts argue that it is the contextual environment of the developing countries which constrains MTEF success.

Required:

(a) Analyse FIVE strategies that developing countries should adopt to minimise conflict between the Medium-Term Expenditure Framework (MTEF) and annual budgeting. (10 marks)

(b) Evaluate FIVE contextual factors that constrain the success of MTEF in your country. (10 marks)

(Total: 20 marks)

QUESTION FIVE

(a) You are a procurement consultant advising a government agency tasked with improving their public sector procurement practices. The agency is responsible for procuring goods and services necessary for various public projects. They are seeking to enhance efficiency, transparency and cost-effectiveness in their procurement processes. In line with this objective the agency is considering the use of consortium buying in its procurement processes.

Required:

(i) Evaluate SIX issues to be agreed upon by the accounting officers of the procuring entities concerned in respect to consortium buying as outlined under section 50 of the Public Procurement and Asset Disposal Act. (6 marks)

(ii) Analyse FOUR measures that the government agency should adopt to address the challenges faced by public sector entities in their procurement practices. (8 marks)

(b) Describe THREE types of National Public funds in Kenya. (6 marks)

(Total: 20 marks)

……………………………………………………………………….